Ar Department Of Revenue Sales Tax . The arkansas sales tax rate in 2023 is 6.5%. 624 rows — arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. Arkansas sales tax rates & calculations in 2023. the atap service allows taxpayers to file and pay taxes online, view their tax account information, and communicate with the department. the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or. arkansas shares sales information with other states and bills arkansas residents for unpaid use tax, plus penalty and interest. This comprises a base rate of. sales and use tax in arkansas is administered by the arkansas department of finance and administration (dfa).

from www.uslegalforms.com

624 rows — arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. The arkansas sales tax rate in 2023 is 6.5%. This comprises a base rate of. Arkansas sales tax rates & calculations in 2023. sales and use tax in arkansas is administered by the arkansas department of finance and administration (dfa). arkansas shares sales information with other states and bills arkansas residents for unpaid use tax, plus penalty and interest. the atap service allows taxpayers to file and pay taxes online, view their tax account information, and communicate with the department. the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or.

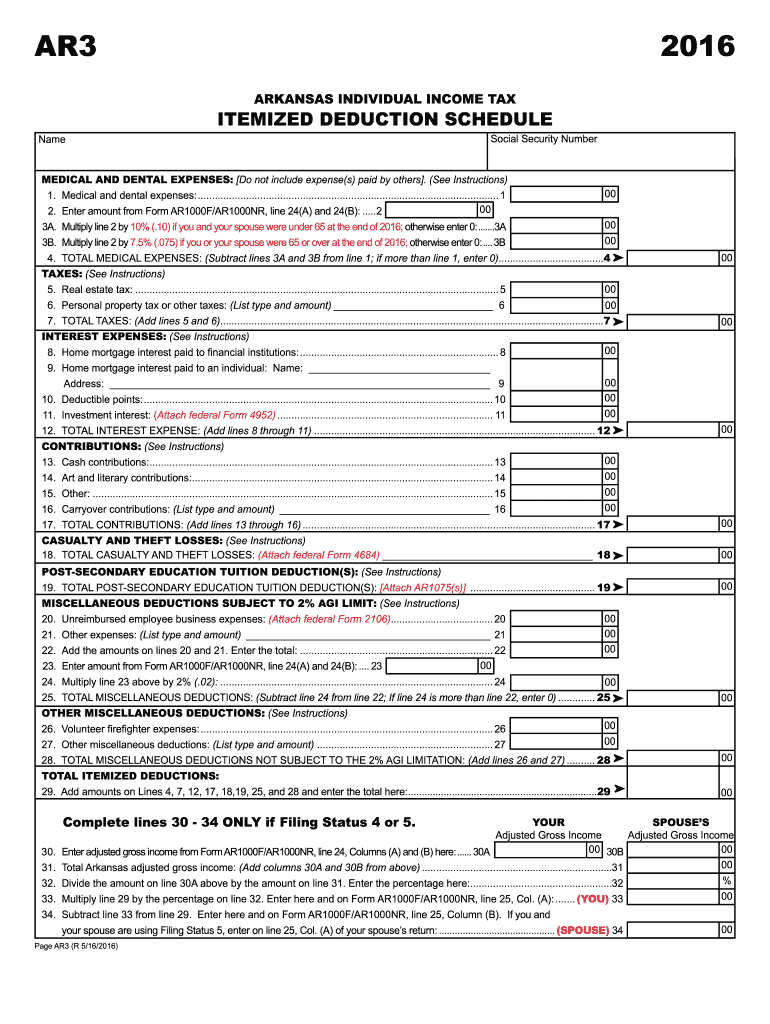

AR AR3 2016 Fill out Tax Template Online US Legal Forms

Ar Department Of Revenue Sales Tax the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or. the atap service allows taxpayers to file and pay taxes online, view their tax account information, and communicate with the department. 624 rows — arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or. Arkansas sales tax rates & calculations in 2023. This comprises a base rate of. the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. arkansas shares sales information with other states and bills arkansas residents for unpaid use tax, plus penalty and interest. The arkansas sales tax rate in 2023 is 6.5%. sales and use tax in arkansas is administered by the arkansas department of finance and administration (dfa).

From www.uaex.uada.edu

New Reports Highlight Arkansas’ Varied Property Tax Landscape Ar Department Of Revenue Sales Tax This comprises a base rate of. The arkansas sales tax rate in 2023 is 6.5%. 624 rows — arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. sales and use tax in arkansas is administered by the arkansas department of finance and administration (dfa). the. Ar Department Of Revenue Sales Tax.

From www.youtube.com

Arkansas Tax Sales Tax Deed YouTube Ar Department Of Revenue Sales Tax the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. The arkansas sales tax rate in 2023 is 6.5%. This comprises a base rate of. arkansas shares sales information with other states and bills arkansas residents for unpaid use tax, plus penalty and interest. the atap service allows taxpayers. Ar Department Of Revenue Sales Tax.

From www.nwahomepage.com

Arkansas Sales Tax Weekend 2022 Ar Department Of Revenue Sales Tax sales and use tax in arkansas is administered by the arkansas department of finance and administration (dfa). 624 rows — arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. arkansas shares sales information with other states and bills arkansas residents for unpaid use tax, plus. Ar Department Of Revenue Sales Tax.

From howtostartanllc.com

Arkansas Sales Tax Small Business Guide TRUiC Ar Department Of Revenue Sales Tax 624 rows — arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or. Arkansas sales tax rates & calculations in 2023. the atap service allows taxpayers to. Ar Department Of Revenue Sales Tax.

From www.pdffiller.com

Alabama Resale Certificate Pdf Fill Online, Printable, Fillable Ar Department Of Revenue Sales Tax the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. 624 rows — arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. This comprises a base rate of. the atap service allows taxpayers to file and pay. Ar Department Of Revenue Sales Tax.

From www.formsbank.com

Form Ar1000a Instructions Amended Individual Tax Return Ar Department Of Revenue Sales Tax arkansas shares sales information with other states and bills arkansas residents for unpaid use tax, plus penalty and interest. The arkansas sales tax rate in 2023 is 6.5%. sales and use tax in arkansas is administered by the arkansas department of finance and administration (dfa). the atap service allows taxpayers to file and pay taxes online, view. Ar Department Of Revenue Sales Tax.

From arinsider.co

Enterprise AR Revenue Projected to Reach 19.5 Billion by 2023 AR Insider Ar Department Of Revenue Sales Tax the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or. 624 rows — arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. Arkansas sales tax rates & calculations in 2023. the atap service allows taxpayers to. Ar Department Of Revenue Sales Tax.

From www.forbes.com

Understanding Your Tax Forms The W2 Ar Department Of Revenue Sales Tax The arkansas sales tax rate in 2023 is 6.5%. the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or. arkansas shares sales information with other states and bills arkansas residents for unpaid use tax, plus penalty and interest. sales and use tax in arkansas is administered by the. Ar Department Of Revenue Sales Tax.

From learningschoolhappybrafd.z4.web.core.windows.net

Sales Tax Exemption Form For Arkansas Pdf Ar Department Of Revenue Sales Tax The arkansas sales tax rate in 2023 is 6.5%. This comprises a base rate of. the atap service allows taxpayers to file and pay taxes online, view their tax account information, and communicate with the department. 624 rows — arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of. Ar Department Of Revenue Sales Tax.

From www.pinterest.com

Sales tax calculator for Arkansas City, Kansas, United States in 2018 Ar Department Of Revenue Sales Tax arkansas shares sales information with other states and bills arkansas residents for unpaid use tax, plus penalty and interest. 624 rows — arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. This comprises a base rate of. the atap service allows taxpayers to file and. Ar Department Of Revenue Sales Tax.

From www.businesser.net

Arkansas Department Of Finance And Administration Bill Of Sale businesser Ar Department Of Revenue Sales Tax arkansas shares sales information with other states and bills arkansas residents for unpaid use tax, plus penalty and interest. This comprises a base rate of. sales and use tax in arkansas is administered by the arkansas department of finance and administration (dfa). the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax. Ar Department Of Revenue Sales Tax.

From 1stopvat.com

Arkansas Sales Tax Sales Tax Arkansas AR Sales Tax Rate Ar Department Of Revenue Sales Tax 624 rows — arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. arkansas shares sales information with other states and bills arkansas residents for unpaid use tax, plus penalty and interest. the arkansas sales and use tax section administers the interpretation, collection and enforcement of. Ar Department Of Revenue Sales Tax.

From www.arkansasonline.com

As tax rates go, Arkansas at top The Arkansas DemocratGazette Ar Department Of Revenue Sales Tax the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or. the atap service allows taxpayers to file and pay taxes online, view their tax account information, and communicate with the department. This comprises a base rate of. The arkansas sales tax rate in 2023 is 6.5%. 624 rows. Ar Department Of Revenue Sales Tax.

From www.formsbank.com

Fillable Agricultural Sales And Use Tax Certificate Of Exemption Ar Department Of Revenue Sales Tax The arkansas sales tax rate in 2023 is 6.5%. This comprises a base rate of. the atap service allows taxpayers to file and pay taxes online, view their tax account information, and communicate with the department. the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or. 624 rows. Ar Department Of Revenue Sales Tax.

From www.uslegalforms.com

AR AR3 2016 Fill out Tax Template Online US Legal Forms Ar Department Of Revenue Sales Tax the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or. This comprises a base rate of. The arkansas sales tax rate in 2023 is 6.5%. Arkansas sales tax rates & calculations in 2023. sales and use tax in arkansas is administered by the arkansas department of finance and administration. Ar Department Of Revenue Sales Tax.

From download.cchaxcess.com

AR Sales Tax Ar Department Of Revenue Sales Tax the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or. Arkansas sales tax rates & calculations in 2023. The arkansas sales tax rate in 2023 is 6.5%. 624 rows — arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of. Ar Department Of Revenue Sales Tax.

From www.dochub.com

Arkansas sales tax registration Fill out & sign online DocHub Ar Department Of Revenue Sales Tax the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or. This comprises a base rate of. The arkansas sales tax rate in 2023 is 6.5%. 624 rows — arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to.. Ar Department Of Revenue Sales Tax.

From webinarcare.com

How to Get Arkansas Sales Tax Permit A Comprehensive Guide Ar Department Of Revenue Sales Tax 624 rows — arkansas has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to. the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. Arkansas sales tax rates & calculations in 2023. This comprises a base rate of. the. Ar Department Of Revenue Sales Tax.